How Payouts Work

Payouts, at a high level, consist of a few pieces: payment processing, reserves, and receiving deposits. At this point, you should know how to process payments before getting into merchant reserves and payouts.

At a high level: Once payments are processed from payer to merchant, they are placed into a merchant's Account and are subject to reserves. From there, a merchant can receive deposits via the Payouts API at a frequency of daily, weekly, or monthly. Review and reserves are necessary steps to ensure protection from fraudulent parties (merchants and/or payers), and must be completed before Payouts can occur.

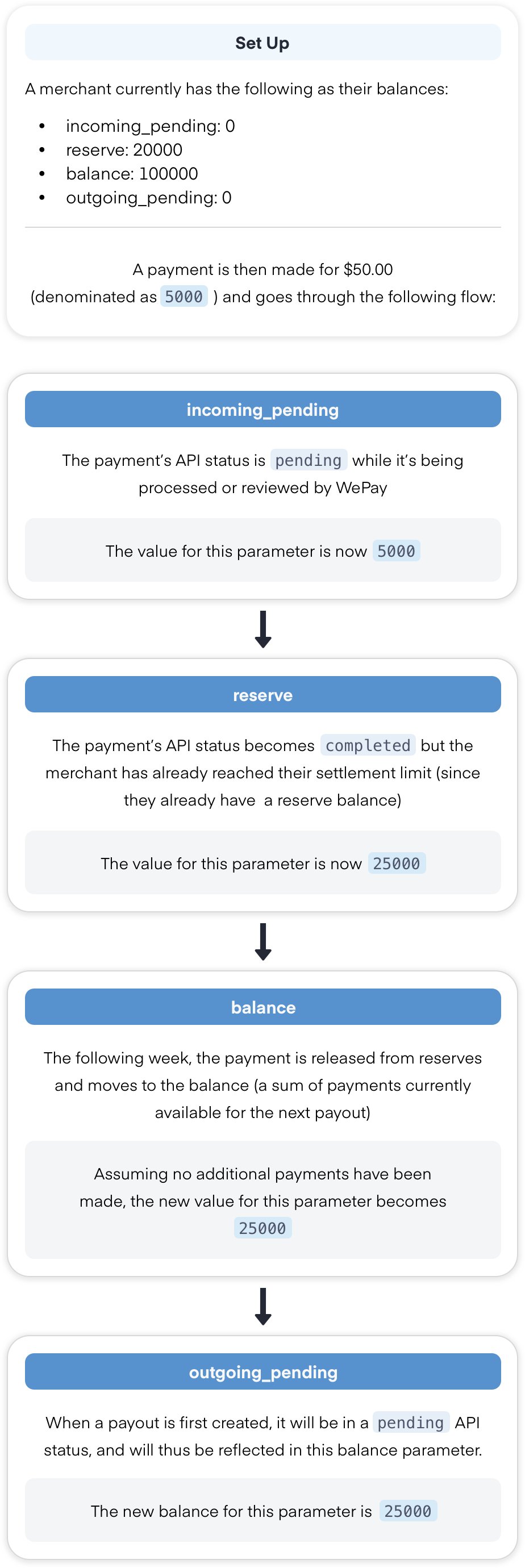

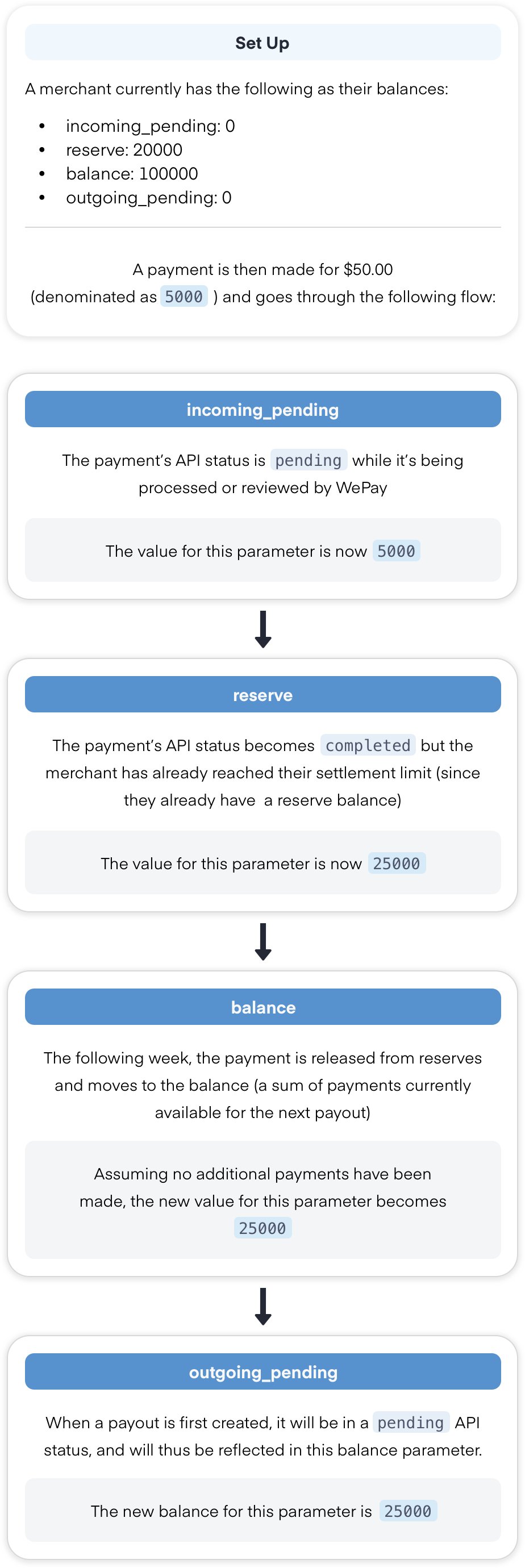

Here is an example of the end-to-end Payment to Payout flow:

Before a Payment can be included in a Payout, the following requirements must be met:

- The Account Capability

paymentsmust be"enabled": true; see here for specifics. - The Account Capability

payoutsmust be"enabled": true; see here for specifics. - The Legal Entity's controller, entity, and any additional representatives must have a Verification status of

"verified": true

- Enabling Payments and Payouts typically satisfy this requirement, but we may also require additional documentation in order to verify a Legal Entity. See here for specifics.

- We take a risk-based approach to verification, and may require additional supporting documentation after a Legal Entity has been verified.

- The Payment must have

"status": "completed"; this means:

- WePay review must be complete and successful

- Any delayed capture Payments must go through the capture step

- ACH/Echeck Payment Methods must be verified (1-3 business days if not already verified)

- ACH/Echeck Payments must pass the 2 business day hold (this is in place to mitigate rejections from the issuing bank)

- The Payment must not be in the Account's reserved balance.

- Identify these Payments by fetching the Account's

balances.currencies.X.reserveand reconciling against theamountfor the Account's most recent Payments.

Reserves

Before a Payment becomes available for Payout in a merchant's Account balance, a merchant's funds will be subject to our reserve policies. A reserve is defined as a threshold on a merchant's account, reviewed by WePay Risk, with any money above the reserve released after 7 days.

Every merchant can have their own threshold, but the default is $500 per week, which means, at most, a merchant can receive $500 per week without any funds being held in reserve. Any amount over this threshold will be available 7 days after the payment was received.

Example 1

Let's say a merchant receives 3 payments of $250 each. The first two payments worth is available for withdrawal (and, if they have a Chase account, potentially settled the same day), but the 3rd payment will not be available until one week after the 3rd payment was made, regardless of payout frequency settings. The same applies for consequent payments after the 3rd.

Example 2

Let's say a merchant receives 3 payments on Monday: $501, $100, and $250. Because payments are not split, the first payment will place the Merchant's account above the $500/week ceiling. As a result, $501 will be available for payouts the following Monday (7 days).

Please contact either your account manager or the WePay support team at support@wepay.com to modify the default $500 per week reserve for merchants. Once your Merchant has available funds (total funds under reserve amount), they can receive Payouts. The next section describes when they will actually receive money.Payouts

We offer automatic Same-Day Deposit capabilities for merchants on your Platform. If a merchant adds a Chase Bank Account where funds are to be deposited, they will receive their cash same day for all payments approved (completed API state) by the cutoff time Sunday-Friday. Plus, Saturday transactions will be deposited Sunday morning. For a non-Chase Bank Account, deposits will occur on the next business day, depending on the receiving bank. Essentially, we are reducing the existing ACH payout window to 1-3 business days (from the historical 2-5). Keep in mind that Payments must meet all 5 requirements above before the 1-3 business day Payout time line comes into effect.

There is no additional cost for this functionality.

For exact time frames and cutoff times, please reference this table:

| SMB / Business Tools | Fundraising | |

|---|---|---|

| Cut-off Time | 5:00 pm PT | 12:00 am PT |

| Funding Time: Chase Bank Account | That Night | That Afternoon |

| Funding Time: Non-Chase Bank Account | Next Business Day | Next Business Day |

| Funding Days: Chase Bank Account | Business Days, Holidays, and Sundays* Saturday transaction will deposit Sunday morning | Business Days, Holidays, and Sundays* Saturday transaction will deposit Sunday morning |

| Funding Days: Non-Chase Bank Account | Business days only | Business days only |

Note

pending and detail_code set to risk_review, funds are subject to a delay of up to 1-2 business days.Same-Day Deposit requirements:

- Depending on your platform's vertical (fundraising or SMB), your merchants will be setup with either a 5 pm PT or a 12 am PT cut-off time for transactions, based on the chart above. Reach out to your integration team, relationship executive, technical account manager, or api@wepay.com to find out more.

- The merchant must be based in the United States.

Same-Day Deposit limitations:

- ACH payments have a built-in delay of 2 business days. Once an ACH checkout is in a

completedAPI state, it will be eligible for Same-Day Deposit. - Saturday Deposits will be available on Sunday morning.

- Funds deposited to non-Chase bank accounts may post as soon as the next business day, depending on the receiving bank.

- Payments which are held in reserves will not be eligible for same day deposit until they are released from reserves. Read more on our reserve policy above.

- All transactions are subject to our terms of service and exclusions therein, including risk assessment and fraud monitoring, which may result in delays.

Clear

Clear Link

Link