Onboard Merchants

Note

The Link offering is currently in BETA.

Typically, merchants onboarding with your platform on Link will be Small and Medium sized Businesses (SMBs), the target customer segment for Link. For the purposes of Link guides, the terms "merchant" and "SMB" are interchangeable.

Note

WePay's Link solution supports merchants in the US only.

SMBs may be onboarded from three different sources, as determined by your contract with WePay:

- Direct Referrals: SMBs which organically discover your platform's services and initiate Chase Integrated Payments signup on their own.

- Customer Referrals - Chase sales: If included in your platform contract with WePay, the Chase SMB sales team will refer SMBs which are a good fit for your platform.

- Customer Referrals - Chase marketing: If included in your platform contract with WePay, your platform will be included in Chase marketing materials in order to generate web traffic from interested SMBs.

The WePay Link Merchant Onboarding experience is outlined in this article.

Registration

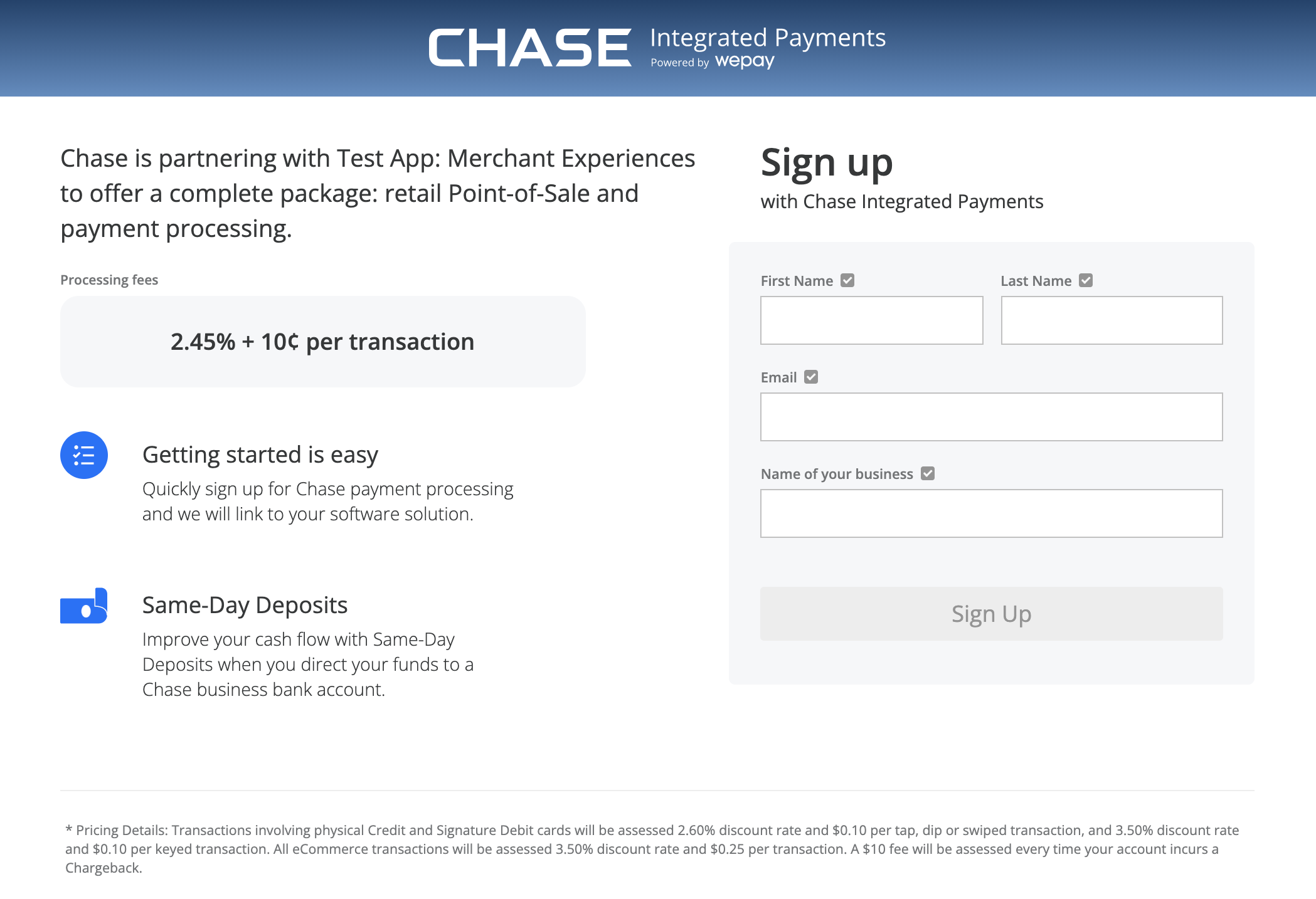

Onboarding Direct Referral SMBs will first create their account with your platform. To start the onboarding flow, you'll host a button for the SMB to activate payments. The button should be prominent in your UI so that merchants know they must click it to start processing payments. Construct this URL by inserting your production application ID (found in your Partner Center) into the following:

- Stage:

https://stage-home.wepay.com/merchant/signup?app_id=[INSERT-YOUR-APP-ID] - Production:

https://home.wepay.com/merchant/signup?app_id=[INSERT-YOUR-APP-ID]

Your merchants will begin registration here:

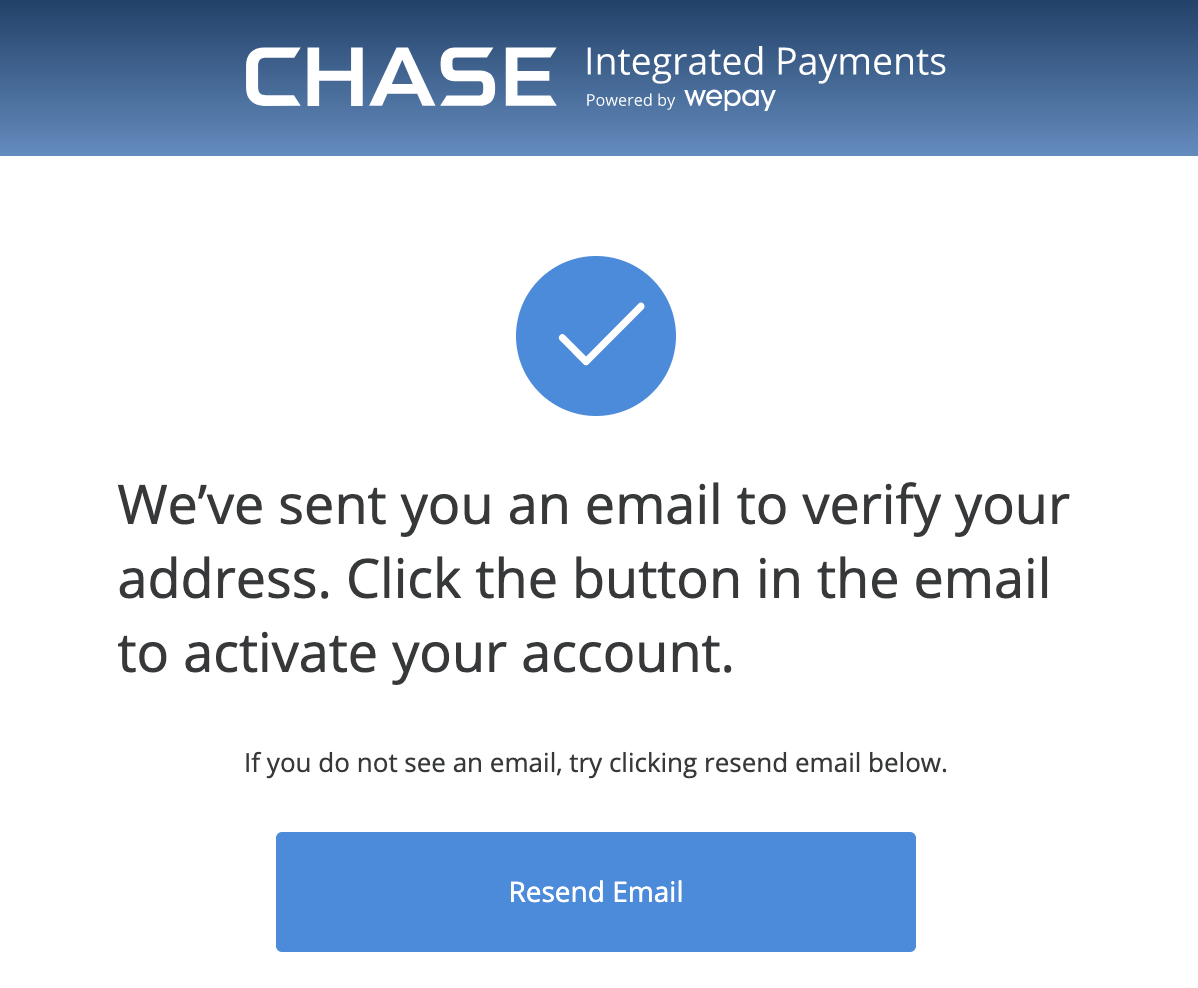

Upon submission of details, merchants will be directed to their inbox:

Onboarding Customer Referrals - Chase marketing SMBs will be directed to a WePay-hosted Chase Integrated Payments signup form from Chase marketing. During integration, you will provide the URL where WePay will redirect SMBs to your site after they have registered.

The registration form for Customer Referrals - Chase sales will be completed internally by the Chase sales team.

Once an SMB has registered for their Chase Integrated Payments account, they can begin accepting payments. Additional steps will be required to grant your platform access to the SMB's Chase Integrated Payments account, and for the SMB to continue accepting payments. These requirements are outlined below:

Confirmation

Upon registration, WePay will direct the SMB to find a confirmation email to complete their Chase Integrated Payments account set up. All onboarding SMBs must click through the confirmation email and set their Chase Integrated Payments account password.

The email to complete registration by setting a password will look like this:

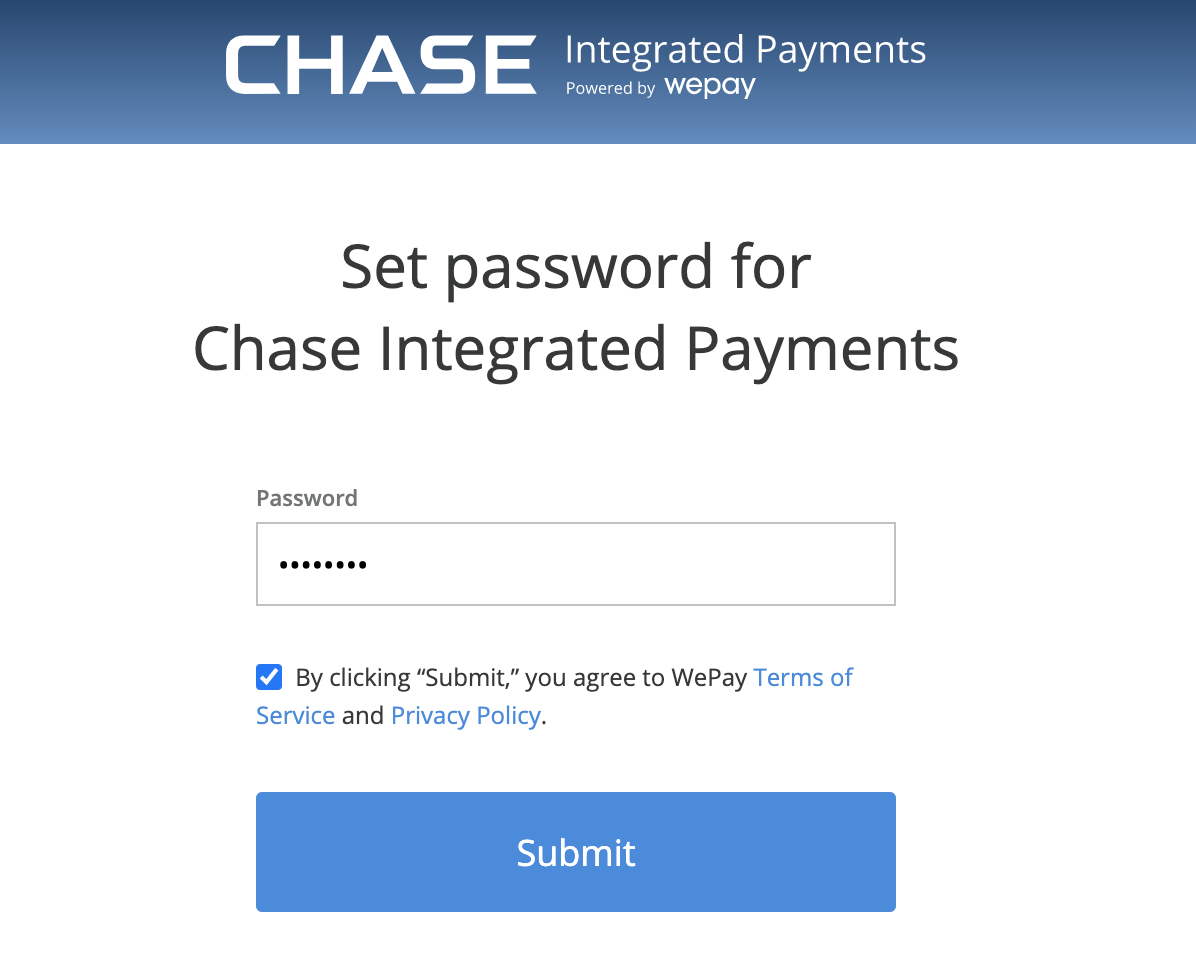

Following the email's call to action will allow merchant to set a password:

KYC and Payouts

After the password has been set, SMBs will be presented with KYC and settlement forms. Submission of these forms is not required up-front, but it is required within the standard account life cycle time frames.

Same Day Deposits

WePay offers automatic Same-Day Deposit capabilities for merchants on your Platform. If a merchant adds a Chase Bank Account where funds are to be deposited, they will receive their cash same day for all payments approved (completed API state) by the cutoff time Sunday-Friday. Plus, Saturday transactions will be deposited Sunday morning.For a non-Chase Bank Account, deposits will occur on the next business day, depending on the receiving bank. Essentially, we are reducing the existing ACH payout window to 1-3 business days (from the historical 2-5).

There is no additional cost for this functionality.

For exact time frames and cutoff times, please reference this following:

- Cut-off Time: 5:00 pm PT

- Funding Time for a Chase Bank Account: That Night

- Funding Time for a Non-Chase Bank Account: Next Business Day

- Funding Days for a Chase Bank Account: Business Days, Holidays, and Sundays

- Note:Saturday transaction will deposit Sunday morning

- Funding Days for a Non-Chase Bank Account: Business days only

Same-Day Deposit requirements:

- Your merchants will be setup will be set up with either a 5 pm PT or a 12 am PT cut-off time for transactions. Reach out to your integration team, relationship executive, technical account manager, or api@wepay.com to find out more. -The merchant must be based in the United States.

Same-Day Deposit limitations:

- ACH payments have a built-in delay of 2 business days. Once an ACH checkout is in a

completedAPI state, it will be eligible for Same-Day Deposit. - Saturday Deposits will be available on Sunday morning.

- For a non-Chase Bank Account, deposits may occur as early as the next business day, depending on the receiving bank.

- Payments which are held in reserves will not be eligible for same day deposits until they are released from reserves. Read more on WePay's reserve policy.

- All transactions are subject to WePay terms of service and exclusions therein, including risk assessment and fraud monitoring, which may result in delays.

At a high level: Once payments are processed from payer to merchant, they are placed into a merchant's Account and are subject to reserves. From there, a merchant can receive deposits via the Payouts API at a frequency of daily, weekly, or monthly. Review and reserves are necessary steps to ensure protection from fraudulent parties (merchants and/or payers), and must be completed before Payouts can occur.

Before a Payment can be included in a Payout, the following requirements must be met: 1. The Account Capabilitypayments must be "enabled": true; fetch the Account to identify.

2. The Account Capability payouts must be "enabled": true; fetch the Account to identify.

3. The Legal Entity's controller, entity, and any additional representatives must have a Verification status of "verified": true; fetch the Legal Entity to identify- WePay takes a risk-based approach to verification, and may require additional supporting documentation after a Legal Entity has been verified.

- The Payment must have

"status": "completed"; this means:

- WePay review must be complete and successful

- Any delayed capture Payments must go through the capture step

- ACH/Echeck Payment Methods must be verified (1-3 business days if not already verified)

- ACH/Echeck Payments must pass the 2 business day hold (this is in place to mitigate rejections from the issuing bank)

- The Payment must not be in the Account's reserved balance.

- Identify these Payments by fetching the Account's

balances.currencies.X.reserveand reconciling against theamountfor the Account's most recent Payments.

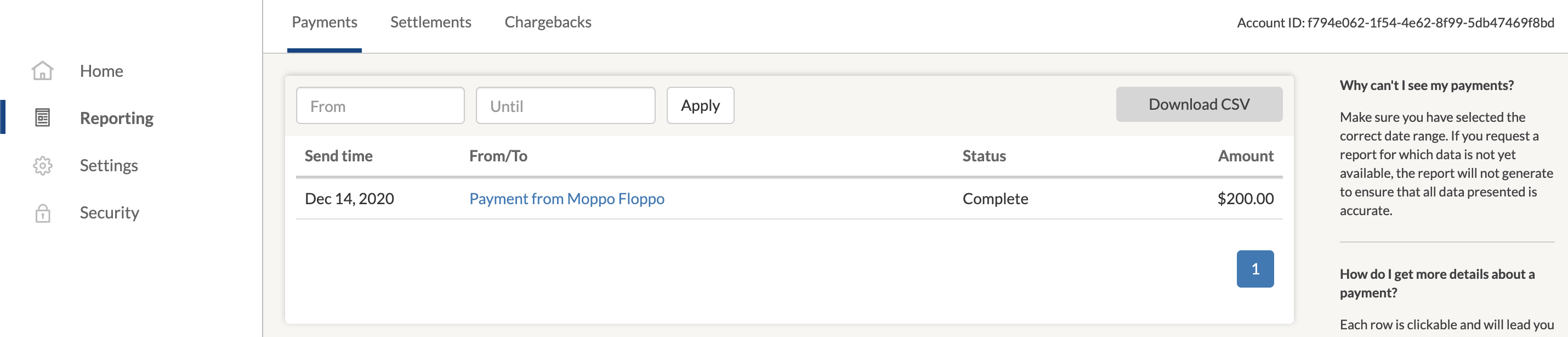

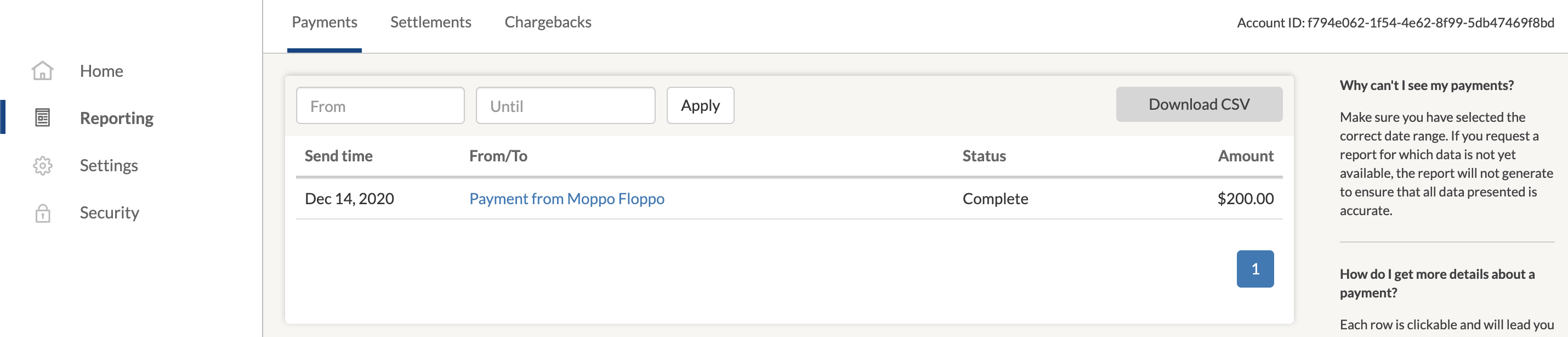

Merchant Center

After submitting or skipping KYC and settlement forms, the SMB will be introduced to the Chase Integrated Payments merchant center (hosted by WePay). This is where SMBs will be able to self-serve:

- Account Management

- Set password

- Manage security settings (2FA)

- Complete KYC

- Set/update settlement bank

- View transaction activity

- Issue refunds

- Manage chargebacks

- View standardized reports for transaction activity and settlement:

Platform Handoff

Up until this point, SMBs from the Customer Referral flows have not started registration with your platform. To this end, you must provide a global registration URL to WePay.

WePay will direct all SMBs (Direct and Customer Referral) to your registration URL, appended with the SMB's account ID. For example, if your platform provideshttp://www.yoursite.com to WePay, WePay will provide an account ID like so:http://www.yoursite.com/?acct=9fc07d7e-5bd9-47b6-b2c6-92c09fee0f6dYour platform must build out logic to present Customer Referral SMBs with a registration flow and Direct Referral SMBs with a login flow.

WePay will send automated reminder email to SMBs which still need to go through the above hand off and complete registration on your platform. This will continue until you update the account by sending a POST /accounts/id request with the following parameter:

{

"platform_onboarding_time": [insert-unix-timestamp]

}Platform Sign Up

This step is only applicable to Customer Referral SMBs.

Once you have a WePay account ID for the Customer Referral SMB, retrieve the associated WePay Legal Entity ID by making aGET /accounts/id request and pulling the owner.id value from the API response. Your request will look something like this:curl -X GET \

/accounts/d3f61e56-5d99-4895-af2d-a07ab48476e9 \

-H "App-Id: 121212" \

-H "App-Token: prod_MTAwXzk5OWIwZT666LWYwNWItNDU4MS1iZjBiL" \

-H "Api-Version: 3.0" \

-H "Content-Type: application/json" \Next, provide a fast-track verification experience for these SMBs by making a GET /legal_entities/id request:

curl -X GET \

/legal_entities/b116768c-dac0-4ef1-8024-7d3056c6b186 \

-H "App-Id: 121212" \

-H "App-Token: prod_MTAwXzk5OWIwZT666LWYwNWItNDU4MS1iZjBiL" \

-H "Api-Version: 3.0" \

-H "Content-Type: application/json" \This will allow you to remove redundant data-entry requests from the merchant experience on your platform based on the API response.

Clear

Clear Link

Link